Amid the complicated Covid-19 epidemic, e-commerce is thought to face a once-in-a-lifetime opportunity. However, after the first quarter, did Vietnamese e-commerce companies manage to take advantage of this opportunity to grow their user base?

E-commerce aggregator iPrice Group and analytics company SimilarWeb announced the latest Vietnamese Map of E-Commerce for Quarter 1, 2020. The report analysing traffic statistics of the 50 leading e-commerce websites in Vietnam is here to answer this question.

Data surprisingly reveals that 3 out of 4 major e-commerce marketplaces in Vietnam actually experienced drops in website traffic this quarter

Local player Tiki’s website received 23.99 million visits per month this quarter, a slight decrease compared to Q4 / 2019, but is still enough to put them ahead of two major competitors Lazada Vietnam and Sendo.

Monthly visits to Lazada Vietnam’s and Sendo’s websites in Q1 respectively decreased by 7.3 million and 9.6 million quarter-over-quarter, giving them both the lowest numbers of website visits since Q4/2018.

Number 1 nationwide this quarter is once again Shopee Vietnam with 43.16 million website visits / month. Shopee Vietnam is also the only one out of the 4 major players to see their website traffic increased quarter-over-quarter.

| Ranking | Name | Q1/2020 Monthly Web Traffic | QoQ | YoY |

| 1 | Shopee Vietnam | 43,156,667 | +14% | +36% |

| 2 | The Gioi Di Dong | 28,590,000 | +2% | -6% |

| 3 | Tiki | 23,990,000 | -2% | 0% |

| 4 | Lazada Vietnam | 19,763,333 | -27% | -7% |

| 5 | Sendo | 17,596,667 | -35% | -20% |

| 6 | Dien May Xanh | 11,180,000 | +8% | +15% |

| 7 | FPT Shop | 8,256,667 | +15% | -5% |

| 8 | Dien May Cho Lon | 7,016,667 | +8% | +228% |

| 9 | CellphoneS | 4,930,000 | -7% | -7% |

| 10 | Hoang Ha Mobile | 4,533,333 | +8% | -14% |

All in all, not counting Shopee Vietnam, the other three marketplaces saw their traffic decrease by 9% on average compared to the same period last year, according to iPrice Group and SimilarWeb’s data.

According to iPrice Group’s analysts, one reason for this surprising downward trend is that during the Covid-19 epidemic, e-commerce marketplaces tend to restrict advertising and promotions, and instead choose to promote livestreaming and games on their applications. The goal is to take advantage of the situation to increase customer engagement, and test new features.

Another major reason is that demands for online shopping during the epidemic keeps changing quickly and unpredictably, causing challenges for E-commerce businesses.

Back in February, when Covid-19 first appeared in Vietnam, online demands for healthcare products such as facemasks and hand sanitisers shot up by 610% and 680% respectively compared to January, as recorded on iPrice.vn. By March, when more consumers stayed at home to avoid outbreaks, it was then the turn for online grocery to take the throne. Visits to online grocery retailer Bach Hoa Xanh’s website increased by 49% quarter-over-quarter as a result.

Unfortunately, these categories were not the primary focus of Vietnam’s e-commerce industry. Among the surveyed top 50 e-commerce websites in Vietnam, only two are specialised in online grocery, and one is specialised in pharmacy. Meanwhile there are 10 mobile device retailers, nine consumer electronics retailers, and seven fashion retailers.

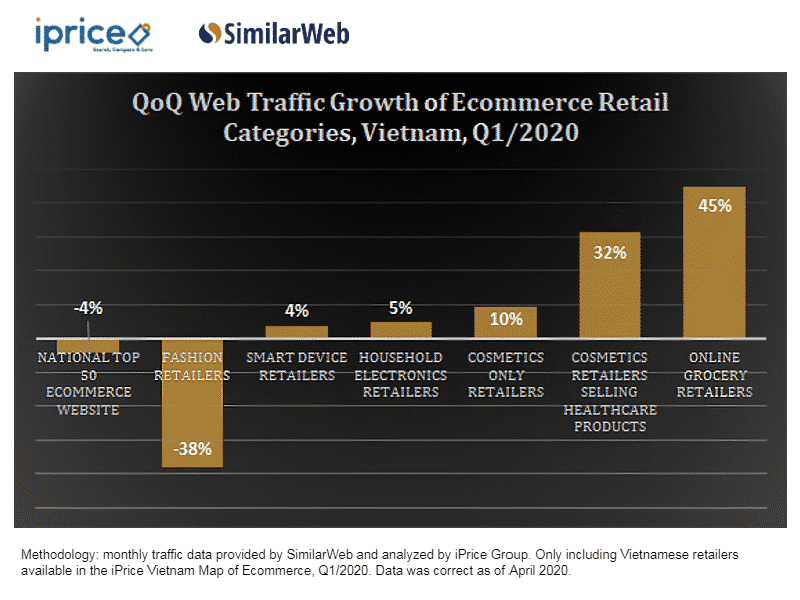

In contrast, the product categories that are traditionally the “golden eggs” of Vietnamese e-commerce such as fashion and electronics, were affected negatively during this epidemic.

In the first three months of the year, fashion retail websites experienced an average decrease of 38% in traffic compared to the previous quarter. Similarly, traffic to consumer electronics retail websites in February decreased by 17% compared to January. Luckily, by March, when people started looking for laptops, webcams, monitors, etc. to work from home, this category had recovered.

However, the four aforementioned major e-commerce marketplaces as well as many other e-commerce businesses in Vietnam sadly only began paying attention to grocery and healthcare products in mid-March. Before that, they were still seen pushing for fashion, electronics, and cosmetics on their websites and in their promotions.

These slow responses somewhat limited the e-commerce industry’s potential to take full advantage of the opportunities brought by Covid-19.

However, after these marketplaces started to change their focus following new demands of the market, by the end of the first quarter, their website traffic also started to go up again, increasing by 6% on average, showing signs of hope for Vietnamese E-commerce in the months to come.

iPrice curates highly insightful data that are unique and unbiased in the world of tech, e-commerce, and online retail by providing data-rich, interactive, and media-specific targeted content that varies from the latest tech trends to the top e-players in Southeast Asia. They also provide high-quality country-specific insights and data on seven markets, namely Singapore, Hong Kong, Vietnam, Thailand, Indonesia, Malaysia, and the Philippines. Through collaborations with data partners such as App Annie Intelligence, SimilarWeb, and Parcel Perform, iPrice has been featured on numerous prominent publications including South China Morning Post, Bloomberg, Motley Fool, Nasdaq, IGN, and Tech Crunch, to name a few.