Building and maintaining a healthy brand is a relentless and ever evolving process. While online sales have seen steady growth in the past decade, the impacts of the pandemic have further accelerated the uptake of digital mediums. In particular, for organisations that have a regional presence, things get even trickier as each individual Asian country has their own digital and social landscape, failure to understand these hyperlocal insights will result in failed strategies.

Competition between foreign and local brands have never been as tight and fierce as it is now. Without studying the background and consumers’ interest, it’s hard to dive in and expect a significant growth of revenue. To keep brands from taking the wrong path, social intel can help narrow down searches for sales opportunities. From knowing the consumers’ behaviour to quantifying PR impact in terms of sentiments and crisis, it will assist to focus on platforms that matter the most. Making it easier to penetrate into the market with better strategy and solutions.

In this feature, Wisesight showcases seven methodologies marketers may leverage to enhance their regional game plans. Simplifying analysis and management of regional initiatives with the help of social data:

The regional brand health check. A ‘regional brand health check’ will enable insights on the intricacies specific to your brand within each market, giving you direction on how your consumers think and truly feel about your initiatives and if they are on point for each country you have a presence in.

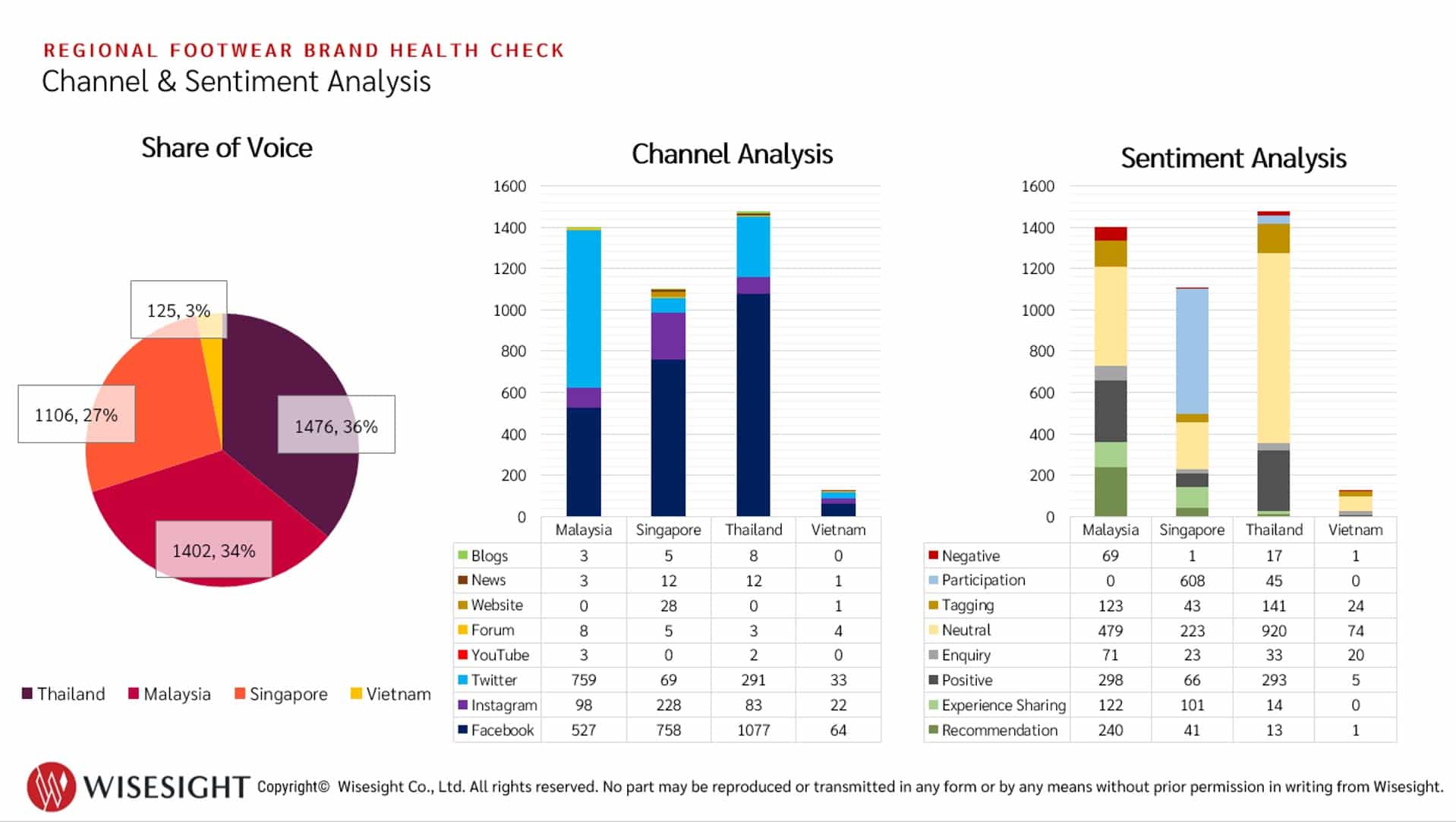

The above charts illustrate a study that was centred on a regional footwear brand’s health for these four countries — Malaysia, Thailand, Singapore and Vietnam. The findings of the study revealed that the highest share of voice came from Thailand and Malaysia, which is 36% and 34% respectively. Despite the fact that the Malaysian population size is lower as compared to Thailand, the rate of consumer’s voice is significantly high and similar for both countries. Implying a high affinity for the brand within the market and even the potential to be top of mind in Malaysia with the right marketing strategies.

The channel analysis. Another methodology that enlightens on the mix of channels to use in different countries would be ‘channel analysis’ as it helps to craft the right social media channel mix strategies to penetrate each APAC country. An example of this for the regional footwear brand Malaysia has a higher concentration of consumer voice on Twitter by 54%. This study is critical as the channel mix varies by industry and audience types.

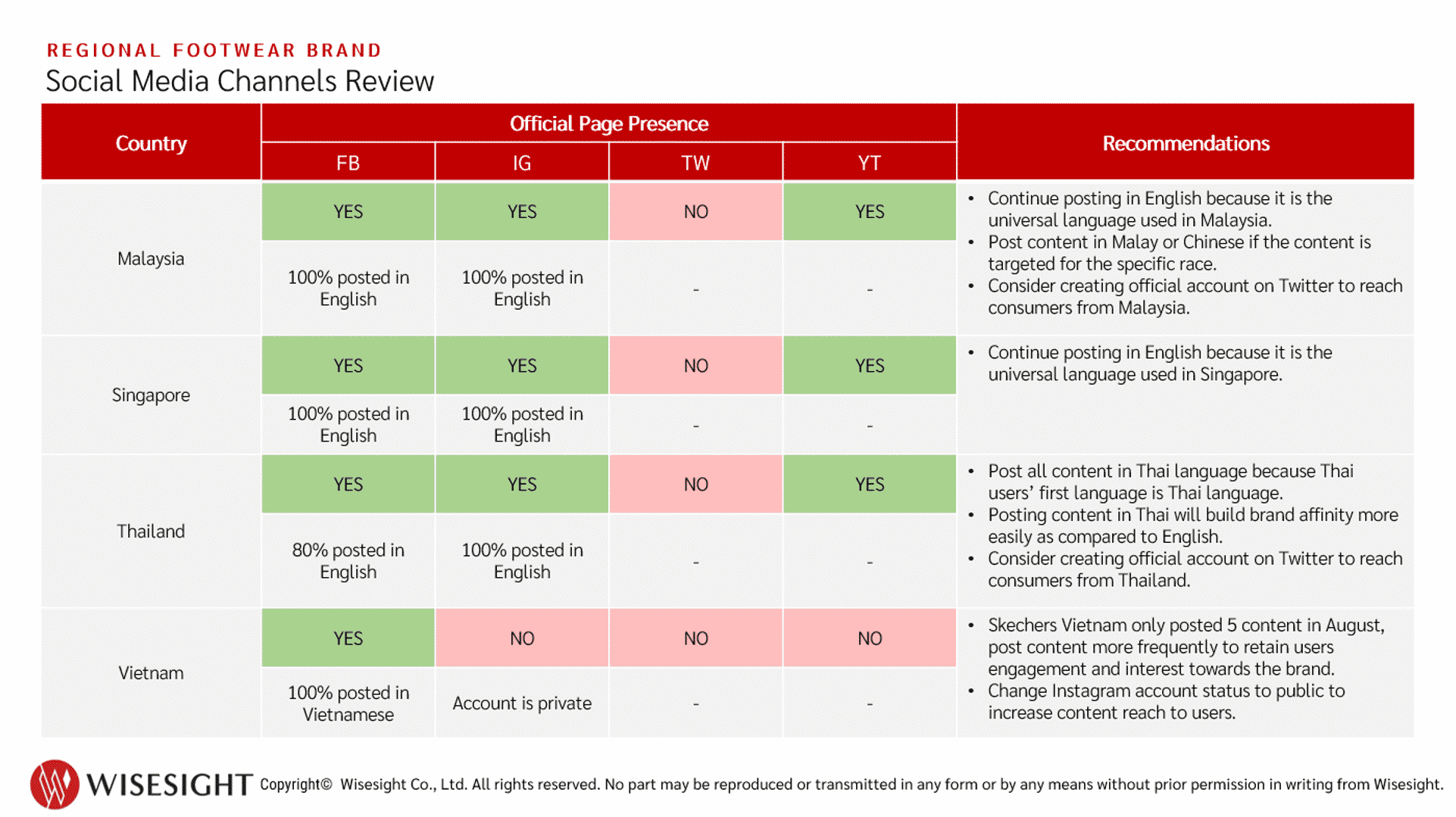

Other findings in the study of the four countries is that the most active users are in Thailand and Malaysia, followed by Singapore and Vietnam. Vietnam was relatively low across channels as the footwear brand had just penetrated into the market during the period of analysis. Other key takeaways a brand could get from this type of analysis especially in multilingual nations like Malaysia, Singapore, India, etc, is the concentration rate of dialects or languages commonly used by fans of a brand, localization of content is needed to capture the attention and raise engagements this study will help you decide to what degree you need to localise and which languages specifically are more important to your audiences.

Sentiment Analysis. ‘Sentiment Analysis’ helps to understand and cater to consumers as it’s a necessity to satisfy their needs, resulting in having a positive impact and sentiments. Analysing sentiments aids brands to identify key areas of focus to improve operationally or product wise, adjust their marketing plan, and tweak their communications and social media efforts to resonate better with their audiences. Ultimately improving overall brand net promoter scoring (NPS).

Micro-KOL identification – Organic influence. While appointing an agency to get influencers is a costly affair, many regional brands are turning to the Micro-KOLs as this segment of influencers are deemed more reliable and perhaps they’re the way forward in some instances. However, identifying them is a challenge in itself. Wisesight’s Micro-KOL identification methodology enables the brand to collaborate with organic fans of their brand, tapping into the holy grail of the marketing funnel “advocacies”.

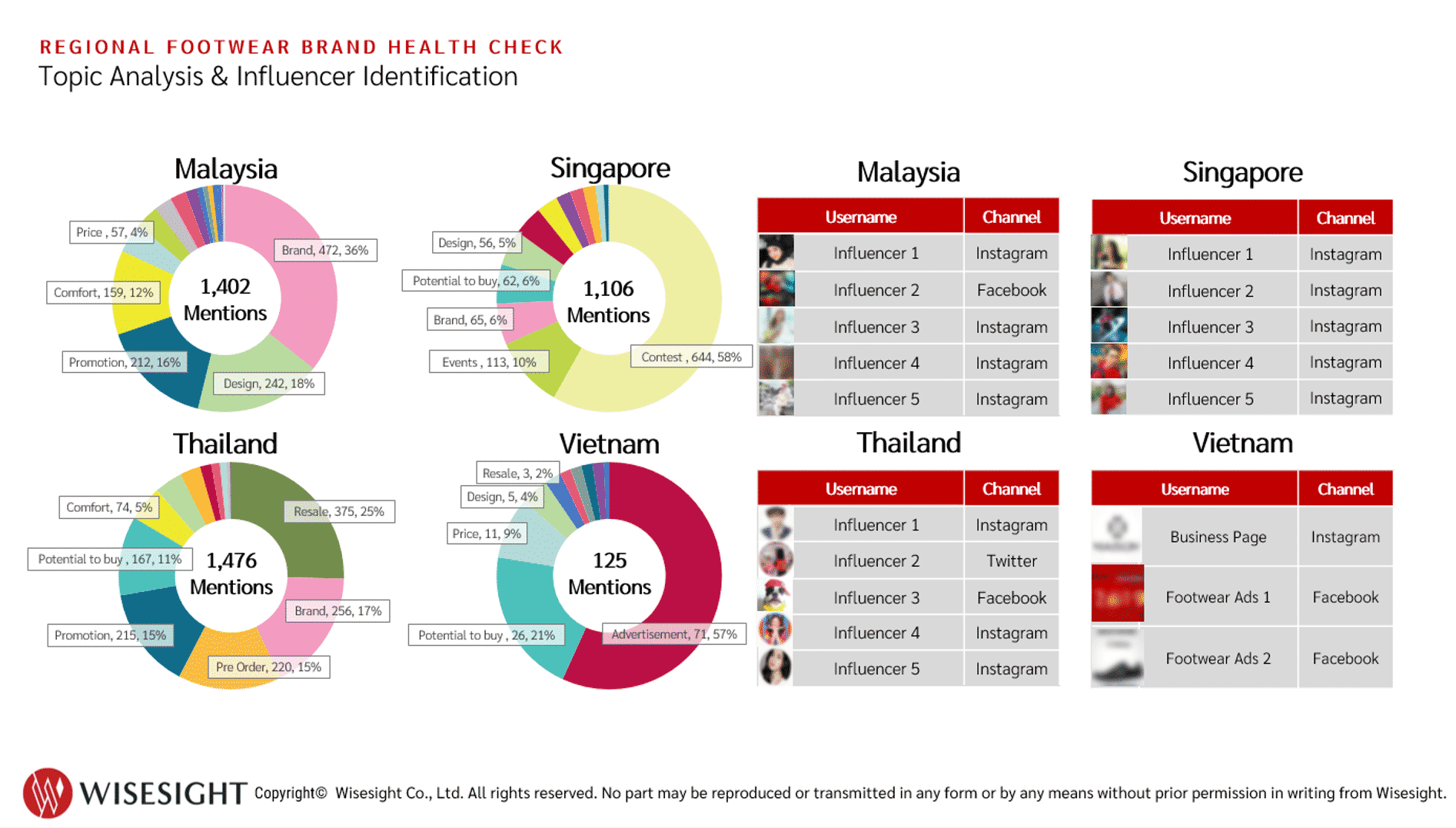

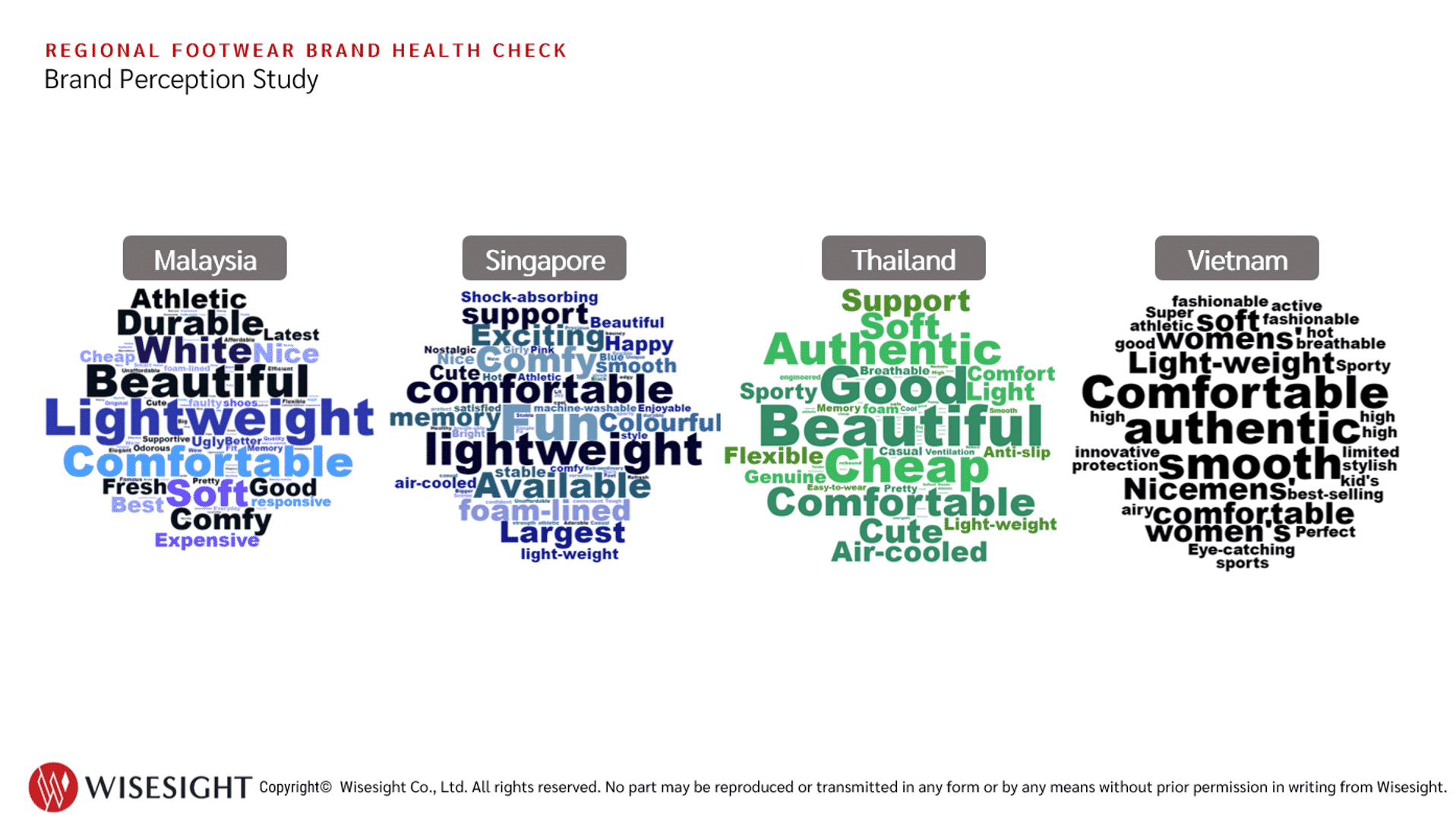

Product analysis. Deep dive analysis specific to products alone will give learning on the key elements to highlight in different countries to attract consumers’ attention. Based on the regional footwear brand’s study findings revealed that netizens were more brandcentric, which indicated their customer’s loyalty towards the brand.

Consumers across the four countries perceive their footwear as comfortable. While Malaysia and Singapore both have positive impressions towards their designs, those in Thailand and Vietnam are more concerned about the authenticity of the shoes due to a penchant for reselling in these markets. With these insights the marketer now has a better picture on how to position their key selling points in each country to resonate best with audiences.

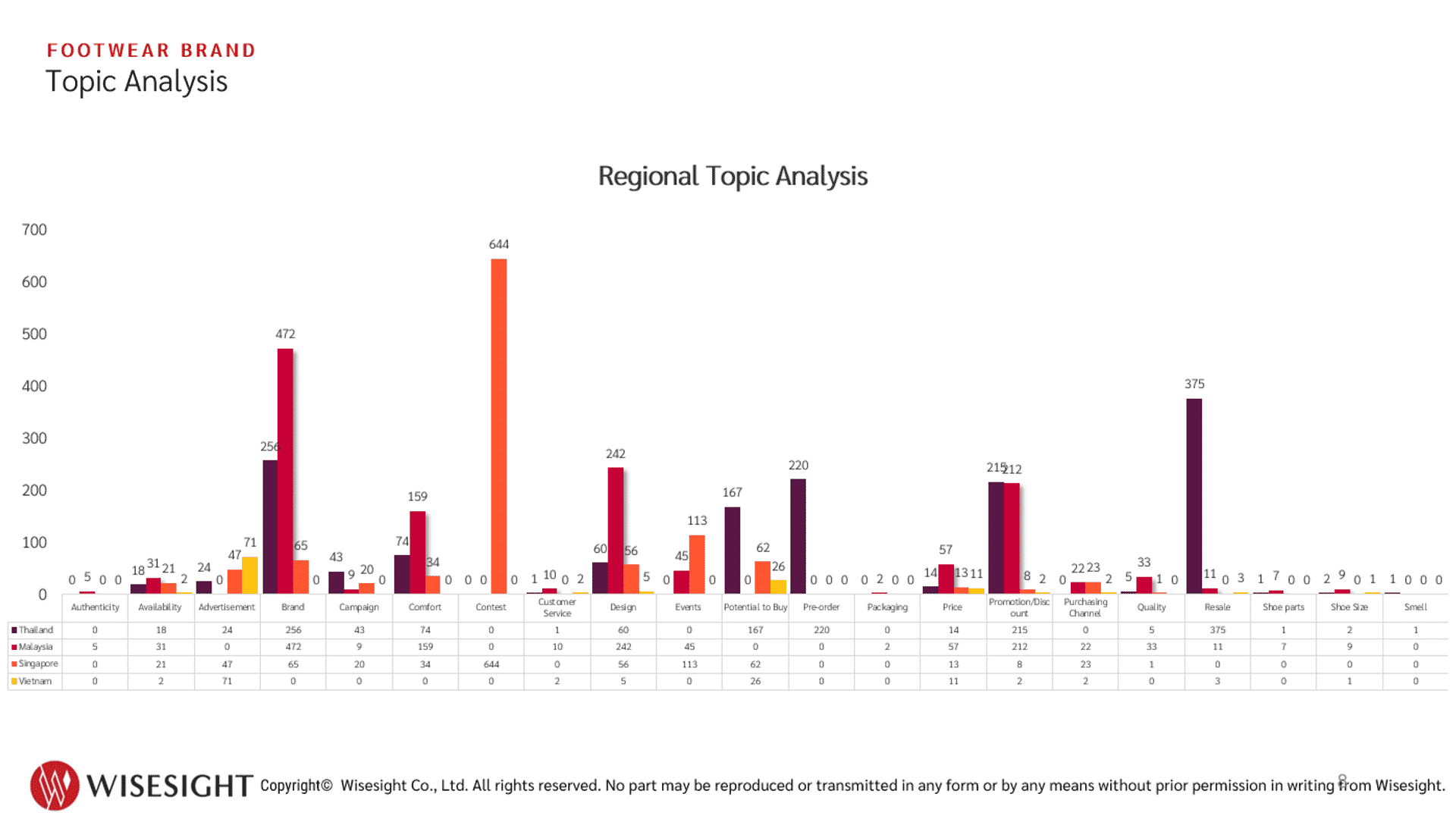

Regional topic analysis. Get into your customer’s head, what are their main concerns and topics of interest. For context, a brand that ran the exact same content calendar across the region garnered varying topic preferences from audiences, the below chart illustrates how Singaporean consumers were contest driven, Malaysia were more Brand centric and Thais keen on resales of the product from the Brand – exact same marketing strategy but different reception.

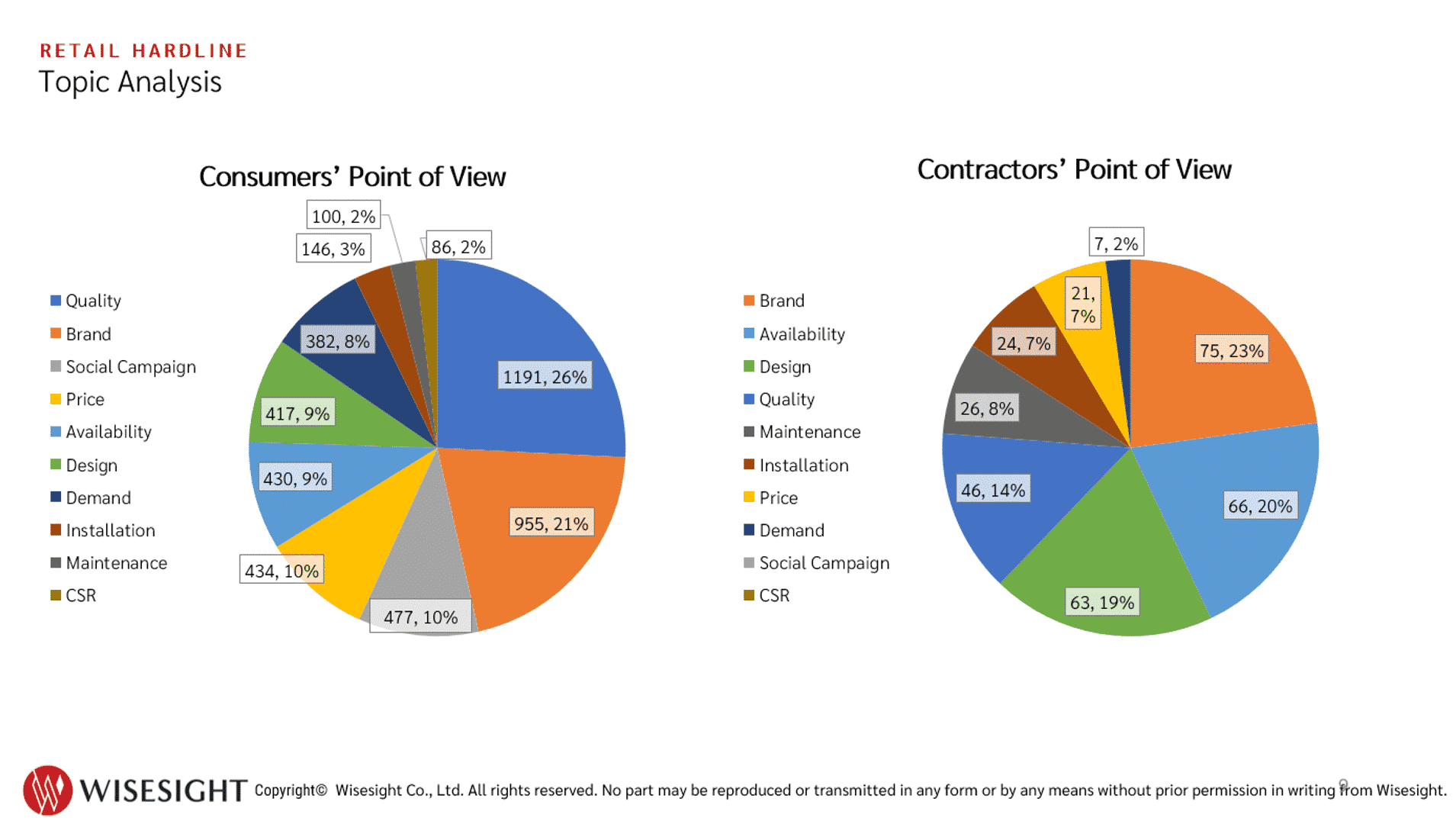

With analyst supported research brands can also study the topics from different parties to understand consumers’ preferences from different segments. This will help brands in understanding the method to target different types of customers. A Wisesight case study for a regional hardline manufacturer during the height of the lockdowns as a result of the pandemic, revealed both contractor and consumers’ priorities were different. Contractors needed to adapt to sustain their business and to target different segments of customers and the end user simply postponed all projects.

Overall, it shows that the end users prioritized their experience and could wait to purchase the product, while contractors focused more on the supply chain of the products. The brand ultimately could plan what the end user would need more of when the lockdowns were lifted and create more communication for contractors on the availability and methods to access their products during the lockdown.

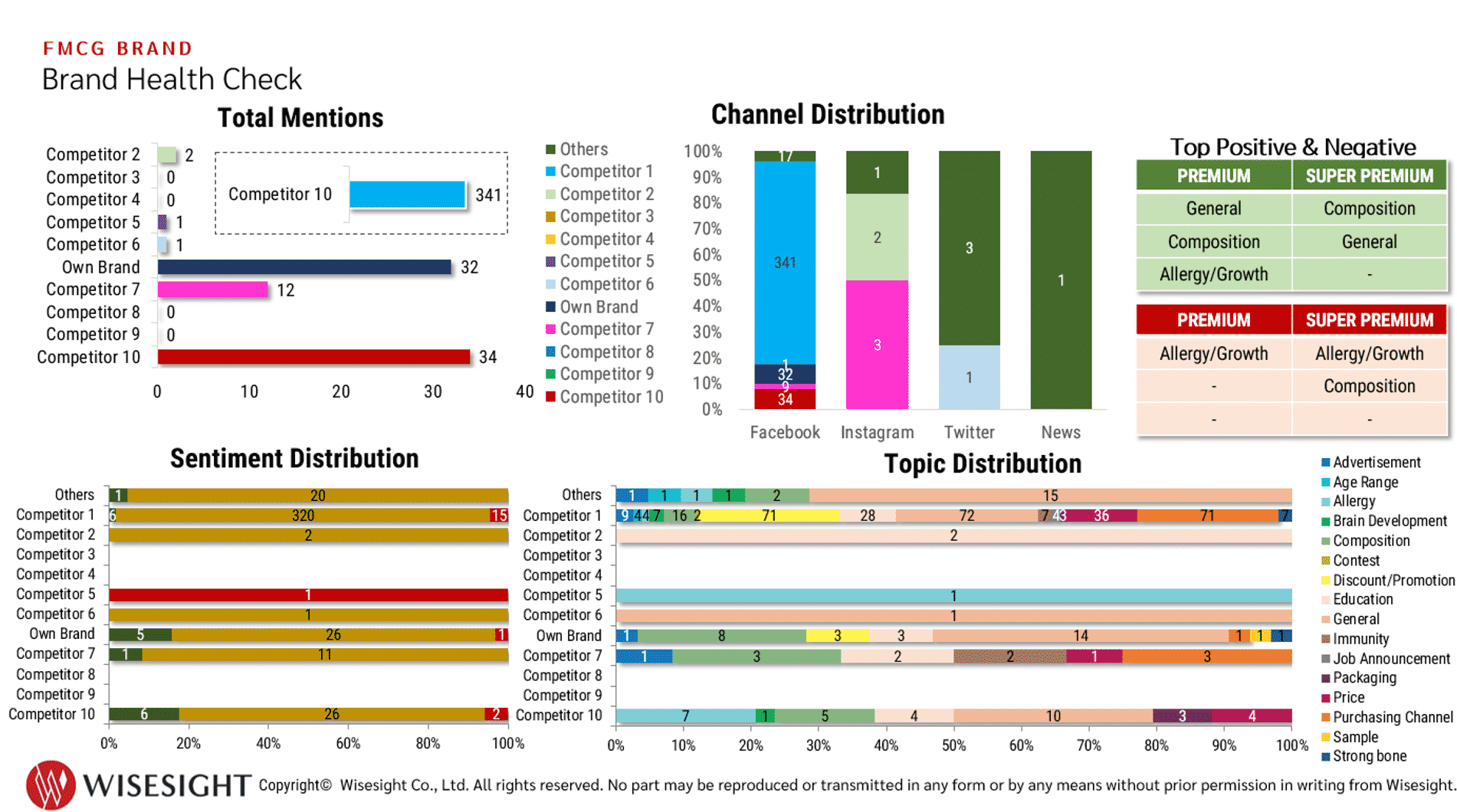

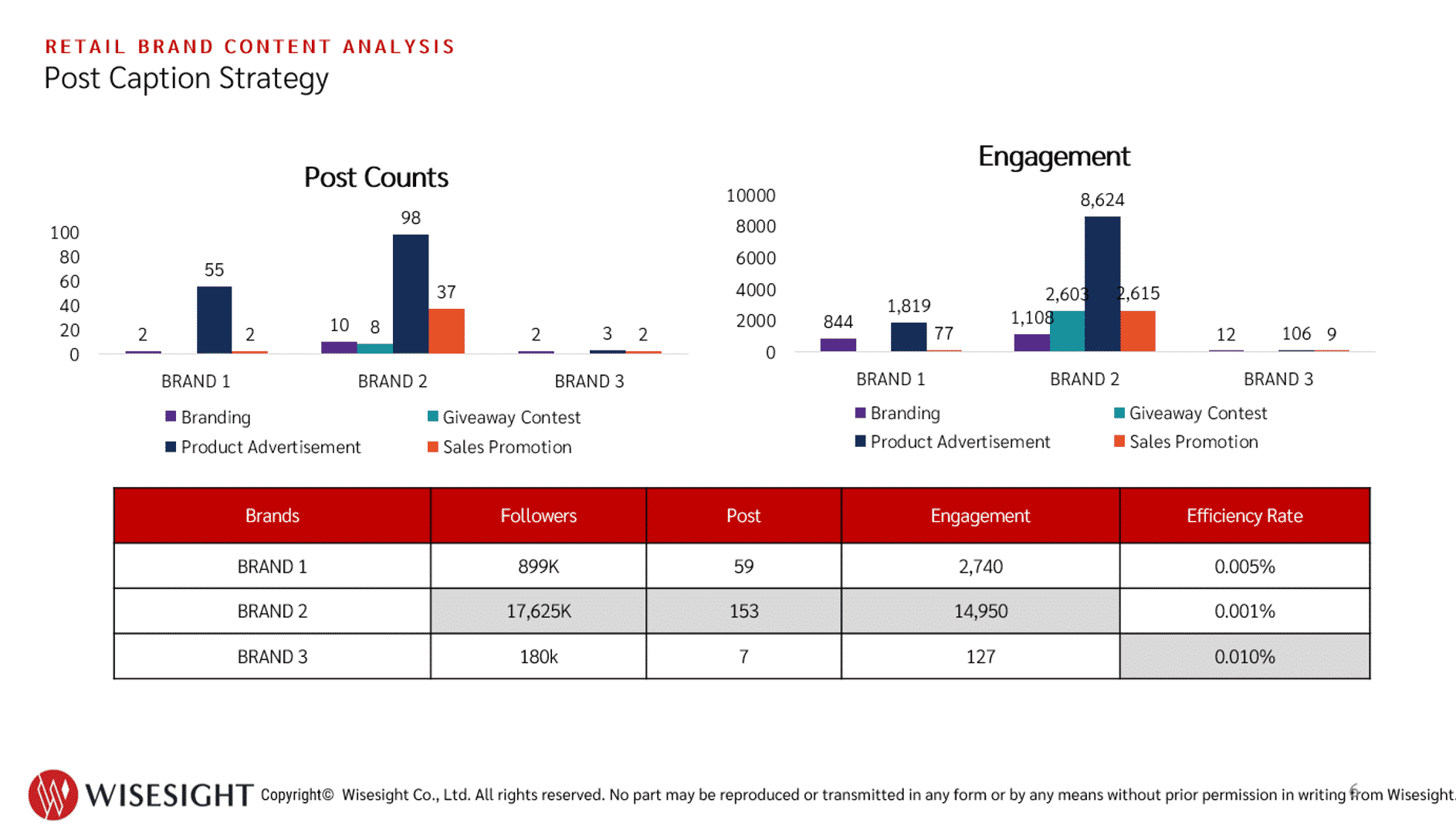

Content performance analysis. Inbuilt social performance insights can only get you so far, in this specific method of analysis aside from learning from your own performance a combination of competitors’ performance will allow you to learn from their successful strategies and failures, continuously improving content posting performance with the insights and tactical recommendations given by Wisesight analysts. In the below analysis, Brand 2 (UNIQLO) only has 0.001% of efficiency rate despite having the highest number of posts among all brands. Clearly the posts and interests between the brand and consumers do not match, resulting in having to do so much more to hit the engagement numbers. The goal should be to have a high efficiency rate post less and gain high engagement too.

Applying these methodologies to analyse consumer’s voice regionally amounts to improving visibility for marketers, streamlining marketing spend and to truly build active communities that serve as organic advocates for your organisation. These methods further help audit the performance of your appointed creative agencies, campaigns, social media content performance and overall marketing strategies.

iWISERS gives you the power to unlock insights from consumer data across social media spheres. We are an elite social intelligence and digital agency providing various in-depth multi-method research, digital marketing and strategy consulting to change the way organisations in APAC engage their communities. Dive into a more immersive experience with us beyond data to power up your brand. #MadeforAsiabyAsians. Follow them on website and LinkedIn.